Canalys: Samsung just edged Apple in a growing Q3 smartphone market | Infinium-tech

The global smartphone market is gradually recovering and reached its highest performance in the third quarter after the pandemic. According to Canalys, companies shipped nearly 310 million units, the best result since July-September in 2021.

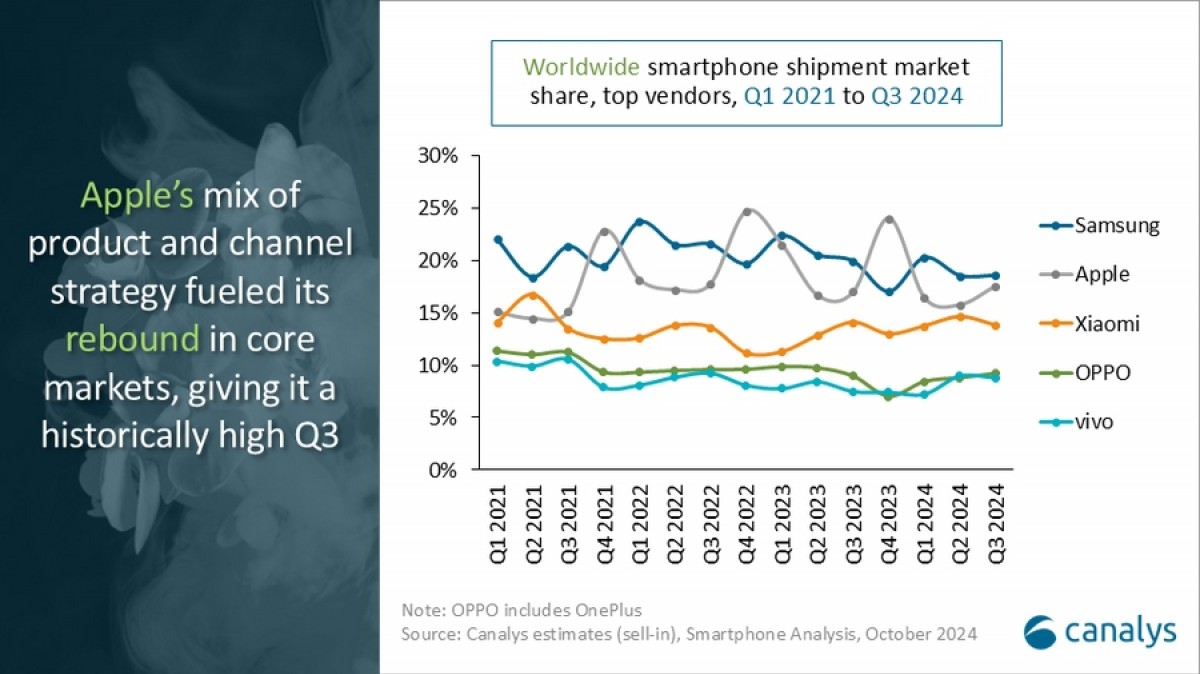

Samsung remained the best-selling OEM in the third quarter, but its lead actually narrowed. Apple was only one percentage point behind, while third-place Xiaomi is only 4pp behind the leader.

Samsung saw a 2-point decline in market share, even though it managed to streamline its entry-level lineup. Apple moved closer to the first position, propelled by the launch of the iPhone 16 series.

Canalys reported that Apple managed to ship older units like the iPhone 13 and iPhone 15 to the Indian market, further improving market share. Expectations are that Apple will take first place in the fourth quarter of 2024, but with a smaller margin than usual due to the delay in Apple Intelligence.

| company | Q3 2024 shipments (in million) |

Q3 2024 market share |

Q3 2023 Shipment (in million) |

Q3 2023 market share |

annual change |

| SAMSUNG | 57.5 | 19% | 58.6 | 20% | -2% |

| Apple | 54.5 | 18% | 50.0 | 17% | +9% |

| Xiaomi | 42.8 | 14% | 41.5 | 14% | +3% |

| opposition | 28.6 | 9% | 26.4 | 9% | +8% |

| Vivo | 27.2 | 9% | 22.0 | 7% | +24% |

| Other | 99.4 | 32% | 95.9 | 33% | +4% |

| Total | 309.9 | 100% | 294.6 | 100% | 5% |

Chinese companies Xiaomi, Oppo and Vivo took a different approach to increase their shipments. Xiaomi relied on its open market presence and brand stores, while Oppo rebranded the A3 series and found success in Southeast Asia in the $100-$200 price segment.

The Vivo V40 lineup might be a bit confusing at first, but five different midrangers with similar names and looks helped the company expand its presence in multiple markets.

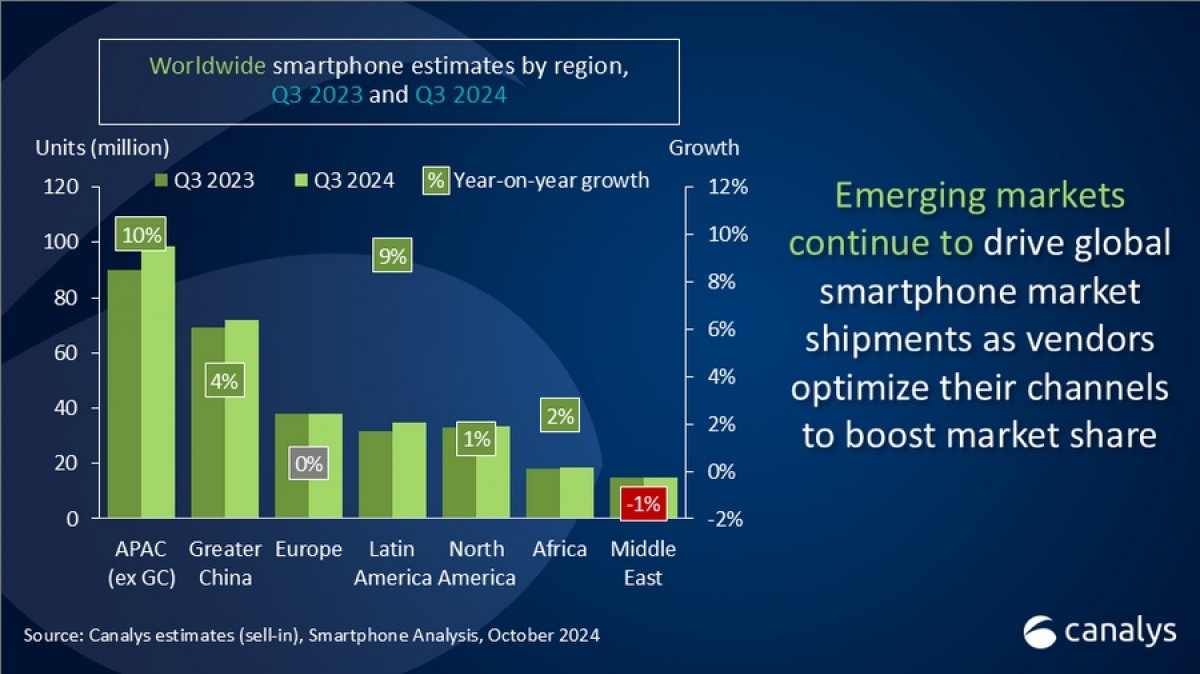

The largest increases in shipments were seen in regions such as Asia Pacific and Latin America. They outperformed the overall market due to increased price competition and channel incentives in the entry-level segment. Canalys warned that affordable phones may be important for volumes and market share, but inflationary pressures limit companies’ profitability.

Expectations for 2025 remain cautiously optimistic. Mature markets like the US, China and Western Europe will see growth in the premium segment through AI-powered devices. Companies like Vivo and Honor are expanding their mid-range portfolio through innovative channel strategies, including pop-up stores and partnerships with carriers to capture upgrades from the $100-$200 price segment.

Leave a Reply